Home

The Importance of Daily Insurance: Why You Need It and How to Get Started

In today’s unpredictable world, protecting yourself and your assets is paramount. Whether it’s safeguarding your health, home, or vehicle, insurance serves as a safety net, providing financial security and peace of mind. While most people are familiar with traditional insurance policies that offer coverage for longer periods, such as monthly or annually, there’s another option gaining traction: daily insurance. In this blog post, we’ll delve into the significance of daily insurance, why it’s essential, and how you can acquire it.

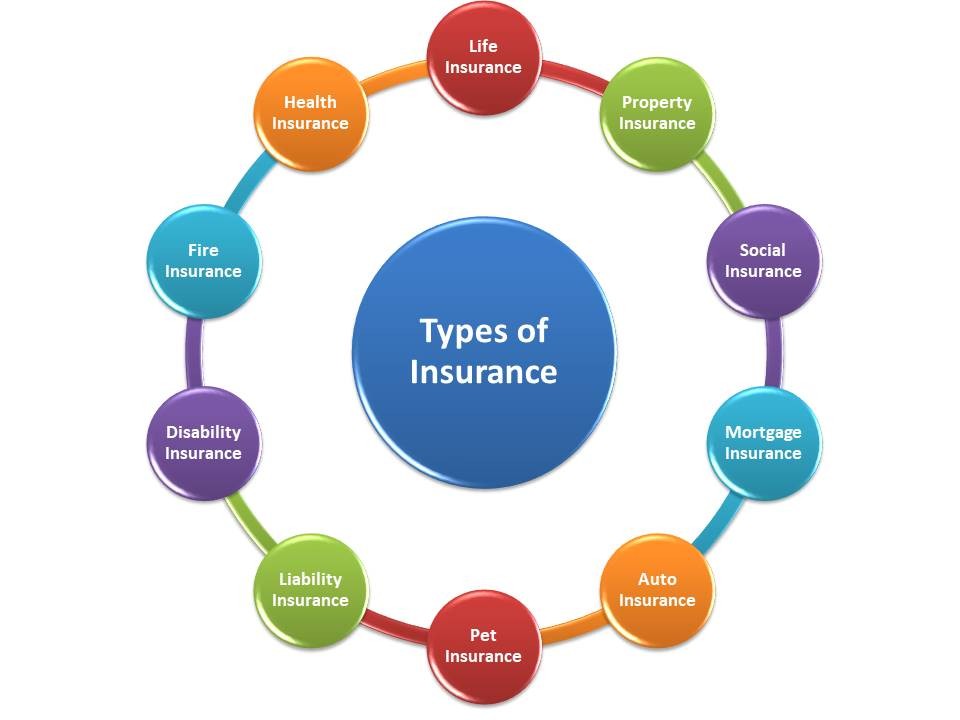

Types of Daily Insurance

Car Rental Insurance: When renting a car for a short period, daily insurance offers coverage for collision damage, theft, and liability,

Travel Insurance: For travelers embarking on short trips, daily travel insurance covers medical emergencies, trip cancellations, lost baggage.

Event Insurance: Whether you’re organizing a one-day event or participating as a vendor or exhibitor, event insurance provides coverage for liabilities, property damage.

Property Insurance: Daily property insurance offers protection for rented accommodations, such as vacation homes or Airbnb rentals,

Understanding Daily Insurance

Daily insurance, also known as short-term insurance, provides coverage for a specific duration, typically ranging from a single day to several weeks. Unlike conventional policies that require a long-term commitment, daily insurance offers flexibility, allowing individuals to obtain coverage for short-term needs or specific situations.

Why Daily Insurance Matters

Flexibility: Daily insurance is tailored to suit diverse needs and circumstances. Whether you’re renting a car for a weekend getaway, traveling abroad for a short trip, or borrowing a friend’s vehicle, daily insurance ensures you’re protected without committing to a long-term policy.

Cost-Effectiveness: For individuals who require insurance for a brief period, daily insurance can be more cost-effective than purchasing an annual policy. Instead of paying for coverage that exceeds your immediate needs, you only pay for the duration you require, saving you money in the process.